Subscribe

Subscribe to EduBridge Blogs

Women in the Financial Space

We live in a time of gender equality and diversity. Gender biases are obsolete as women become equally or even more powerful than men. The long-held belief that men predominated in particular occupational profiles has shifted. One industry where men predominate more than others is the financial sector. This is due to the fact that banking, finance, insurance, and other related topics are viewed as money matters, and there is a long-standing belief that males of the house were responsible for managing funds and doing financial planning. This convention is changing as women become equally involved in financial decision-making and become more financially knowledgeable.

Financial inclusion has become an essential part of the economic empowerment of women. Through this article, we shed light on the barriers to financial inclusion for women in India, analyses the gender gaps that exist, and consider how digital services could be used to address the issues.

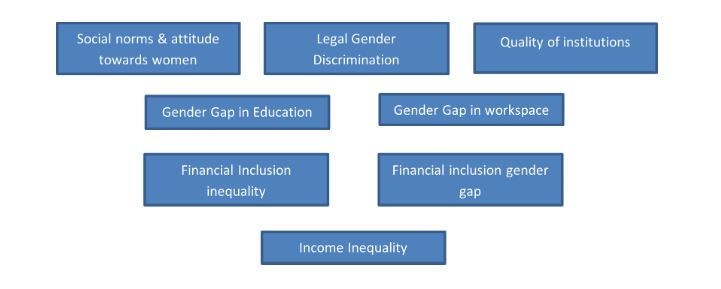

GENDER GAPS AND INEQUALITIES PREVALENT

EMBRACING THE GENDER PERSPECTIVE

More women may enter the mainstream if the burgeoning Indian financial markets were approached with a gender-neutral mindset. Women’s access to banks will be aided in the beginning by preserving a strong network of female banking correspondents and appropriate accompanying infrastructure. Mobile financial services can be made more widely available and approachable so that women can perform transactions from their homes, further resolving mobility difficulties. The poor uptake of digital financial services by Indian women is another serious worry. In order to maximize the involvement of women and enable them to access better digital services, secondary measures should be implemented, including a larger and deeper penetration by mobile and telecom enterprises.

Taking a client-centered approach while taking into account regional and socio-cultural differences will be necessary when designing financial products geared toward women. This approach will be informed by studies on women’s interactions and relationships with money, financial products, and technology. There may be less resistance between women and technology if design features like voice and video facilitators and vernacular communication are included.

At the institutional level, gender budgeting and targeting can enable modifications to public programs that address the unique requirements and preferences of women and improve their access to financial goods. Such financial solutions ought to enable more discretion and control over income and spending choices. More people need to be aware of banking and have access to digital literacy. Financial literacy can assist in mobilizing small funds and delivering them to last-mile female users. The Reserve Bank of India (RBI) has already started a “Financial Education Initiative” to further this aim.

Through appropriate reforms, innovations, and practices, decreasing the gender gap in financial inclusion in India can significantly contribute to resolving economic inequities and enable women to take a more active part in driving growth and development. Making sure women have more agency and meaningful engagement can be essential to advancing all of the sustainable development goals holistically.

Recent Blogs

Related Blogs

Accelerate Your Career with Expert Guidance and Guaranteed Job*!

"*" indicates required fields