Course Highlights

About the program

A professional accountant with a mastery of business sense is essential to the success of any business. Digitalization demands for E-Accountants or Smart Accountants have increased rapidly for calculating the process of tax assessments for organizations or individuals. Today, as the business landscape changes at an unprecedented scale, organization-wide strategies are becoming more dynamic. The business market is transposed with the advent of technology, and the world is becoming a global village. But certain things remain the same, even with this transformation. Accounting experts are still responsible for maintaining financial records, tax payments, and account management!

Accounting has become an in-demand area of expertise over the years. Every industry and organization, regardless of size, necessitates skilled finance, accounting, and taxation experts. Considering all these parameters, this course is structured to train aspirants with industry-specific skills, tools, and software. This will make them job-ready and equipped with the acumen to manage situations at work in real time.

In this accounting course, learners will gain knowledge via homework, quizzes, and exposure to Microsoft Excel and Tally Prime. To stand out financially, they will get hands-on experience through practice questions, assignments, Tally projects, and Mock Interviews. This accounting and taxation course will help you build a strong foundation in Accounting and Taxation, emphasizing developing your analytical skills. By enrolling in this course, you will gain hands-on experience with practice questions, assignments, Tally projects, and Mock Interviews for the competitive corporate world.

All sessions and assessments will be conducted and evaluated online. During the training program, learners will work on capstone projects that will solve real-world problems. The knowledge and skills they gain working on projects, simulations, and case studies will place them ahead of the competition.

This certification programme, in collaboration with IBM, aims to help beginners and professionals get proficient at skills that are critical to today's career opportunities.

An expert-led course on Employability Skills worth INR 3000 is included in this course, absolutely free!

In addition to academic credentials, the majority of employers search for specific talents and attributes in job candidates. Although they might not be job-specific, these abilities, sometimes referred to as employability skills, are crucial for increasing your productivity and value at work. These skills allow you to work well with others, apply knowledge to solve problems, and fit into any work environment. They also include the professional skills that enable you to be successful in the workplace.

This course will,

- Help gain knowledge of Accounting Concepts and the interpretation of Financial Statements.

- Assist learners in creating subsidiary ledgers, such as Accounts Receivable and Accounts Payables.

- Help understand how to maintain a balance between debits and credits.

- Focus on evaluating a company's efficiency and profitability using Ratio Analysis and Cost Flow Methods.

- Help get exposure to current and real-time industry trends and requirements.

We hope that you will gain the required knowledge from this program and demonstrate the skills learnt.

All the best!

Choose a Passport that helps you build a career of your choice.

Eligibility criteria

Syllabus

Syllabus

Uncover the top skills taught in our comprehensive course

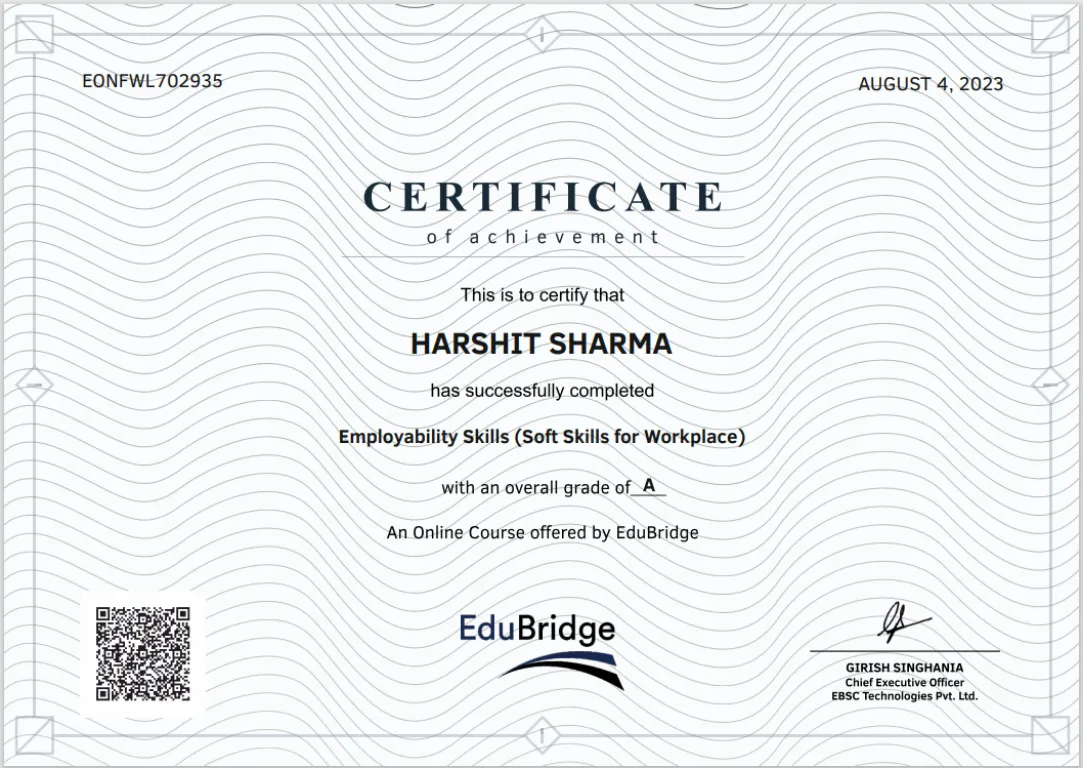

Industry recognized certificate

Earn your EduBridge Accounting and Taxation with GST and Tally course certificate, Employability Skills certificate and three IBM course certificates.

EduBridge offers an in-depth course designed to ensure our learners a pathway to jobs; these certificates are proof of mastery.

Learners will be awarded the Certificate of Achievement on satisfying the requisite attendance criteria and successfully clearing the assessments with a 50% score and above.

Our learners can share their Certificates on LinkedIn, Twitter, and Facebook, boost their resume, frame it, and tell their friends and colleagues about it.

Changing Lives, Transforming Careers

Frequently Asked Questions

To Know More About Secure Your Salary please visit: https://www.edubridgeindia.com/secure-your-salary

Yes, IBM badges are recognized globally by the global IT industry. Getting a certification from IBM may help in boosting and change a career. It is worth noting that the IBM data science professional certificate in Coursera claims that 26% of the enrolled learners have successfully started a new career after completing the course.

Participants will engage in a dynamic and immersive learning experience designed to bridge theoretical knowledge with practical application through various engaging activities. Real-world case studies will be a prominent feature, enabling participants to tackle complex scenarios encountered in actual business environments. These case studies foster critical thinking and problem-solving skills, allowing participants to analyze and devise effective solutions to authentic financial and taxation challenges. Group discussions will encourage collaborative learning, enabling participants to exchange insights and perspectives with peers. This interactive approach promotes a deeper understanding of concepts as participants engage in thoughtful debates and share diverse viewpoints on accounting and taxation topics. Additionally, participants will have the opportunity to engage in Internet research, encouraging them to explore specific areas of curiosity within the realm of financial management and taxation. Presentations will be pivotal in enhancing participants' communication skills and their ability to articulate complex ideas. By preparing and delivering presentations on various accounting and taxation subjects, participants develop the confidence to convey their understanding effectively to diverse audiences. Doubt-clearing sessions will provide a platform for participants to seek clarification on challenging concepts, ensuring that no questions go unanswered and that participants maintain a strong grasp of the material. Regular assessments will gauge participants' progress and understanding throughout the course, providing valuable feedback for continuous improvement. These assessments will test participants' application of concepts, practical skills. Ultimately, the program's blend of case studies, group discussions, Internet research, presentations, doubt-clearing sessions, and assessments creates a comprehensive learning journey that prepares participants with the practical expertise, analytical capabilities, and collaborative skills required to succeed in the dynamic fields of accounting, taxation, and financial management.

Assessments are visible to you in the 'My Courses' section. Your Trainer will activate this post completion of the sessions. Once the Assessments are activated, you will get a notification on your 'My Calendar' option about the same.

Having an IBM certification can also help to stand out in a competitive job market, as it shows that one is dedicated to his/her career and has a strong understanding of IBM technologies. This can help the learner stand out from other job applicants and improve their chances of getting hired.

At EduBridge, we are committed to delivering top-quality interview services to our learners. Our team works diligently to match learners with suitable interview opportunities in alignment with their skills and preferences. However, unforeseen circumstances can sometimes arise that may prevent us from fulfilling our commitment to provide interviews to the learner. In the unlikely event that we are unable to secure an interview opportunity for the learner, we offer a refund of INR 30000* on the Job Passport and INR 15000* on the Interview Passport. • Eligibility for Refund: The learner will be eligible for a refund if we have been unable to arrange interview opportunities as mentioned in the Terms & Conditions*. • Amount of Refund: The amount as mentioned above of INR 30000 and INR 15000 will be subject to full fees being paid by the learner. In case a learner has been awarded any discount on the course fees during enrolment, the said percentage of discount would also be adjusted during the refund. For example – Course Value is INR 80000 and during enrolment, learner was awarded a discount of 10% and therefore the net fees paid was INR 72000. In this situation, 10% would be deducted from the refund amount as well and in case refund situation arises, the amount refunded would be INR 27000 (for Job Passport) or INR 13500 (for Interview Passport). • Refund Process: To initiate the refund process, the learner must submit a written refund request to wecare@edubridgeindia.in. The request should include the learner's full name, contact information, and enrolment details. • Processing Time: Once we receive a valid refund request, our team will review the case and process the refund within 30-45 working days Refund Amount: The refund amount will be issued using the same payment method used during enrolment. • Non-Applicability: The refund policy will not apply if the learner falls into any of the criteria which make the service void. This has been detailed in the terms and conditions section as well. Please note that this refund policy is designed to provide a fair resolution in cases where we are unable to fulfil our commitment to secure an interview opportunity. We remain dedicated to assisting our learners to the best of our abilities and aim to achieve successful outcomes for all learners. If you have any further questions or require clarification regarding our refund policy, please do not hesitate to contact our customer support team.

The online live classes are of 3 hours. However, there are no mandatory daily timelines for the learn-by-yourself modules. You can dedicate as many hours as possible to those sections.

We have a dedicated calendar section on the Learner Portal. Here you can see your planned classes at least a month in advance. We also send out e-mails and SMS as reminders.

You must have a minimum of 70% attendance in the online classes to be able to utilise the services offered under the Interview Passport and Job Passport programs.

IBM skills are recognized and valued worldwide, so an effective way to easily share knowledge and expertise with the professional network is essential for the career growth of our learners.

We follow a blended training approach here at EduBridge. There will be a mix of live trainer-led sessions, some videos with voiceovers and pre-recorded videos that are learn-by-yourself mode.

Upon successfully completing the course, participants will be awarded an industry-recognized certificate that signifies their achievement and competence in the fields of accounting, taxation, and financial management.

Don't worry! You can attend weekend doubt-clearing sessions, which are topic-based classes conducted by our Senior Subject Matter Experts. You will receive regular invitations and notifications on the portal, WhatsApp, or email.

You will be required to submit your PAN card, AADHAR details, Marksheets of 10th, 12th, and Graduation, Supporting educational certificates and any other requirements as mandated by the recruiters.

If the learner has work experience in a different field than the course they are enrolling in, they will be considered freshers and not as having relevant experience. Only relevant work experience in the said course is considered as a work experience learner in any course.

If an IBM exam is not completed successfully on the first attempt, there is no waiting requirement before taking the test a second time. However, candidates may not take the same test more than twice within any 30-day period.

We hope that such a situation does not arise as we offer you 3 upcoming schedule options to choose from, so we hope you choose wisely. In an unfortunate event, when you do need to change the batch, you can request a batch change before you attempt the Entrance Level Test. You can change a batch only once in the lifetime of the course.

The "Certification Program in Accounting and Taxation" is a comprehensive course designed to provide individuals with a strong foundation in accounting, taxation, and the use of accounting software, specifically Tally, in conjunction with understanding Goods and Services Tax (GST) regulations. This course aims to equip participants with the necessary skills and knowledge to manage financial records effectively, comply with taxation requirements, and utilize accounting software for streamlined financial management.

Elite Learner's Club is a loyalty program for our learners that will offer continuous learning through our various services. Click here for more information: https://www.edubridgeindia.com/refer-and-earn

IBM certification is considered to be a great way to demonstrate technical skills and knowledge to potential employers.

The curriculum covers a broad spectrum of topics, starting with an insightful "Introduction to Accounting," offering participants a foundational understanding of financial transactions, the significance of debits and credits, and the importance of meticulous record-keeping. In conclusion, the "Certification Program in Accounting and Taxation with GST and Tally" offers an all-encompassing journey through the intricate landscape of financial management, accounting practices, and taxation regulations. By merging theoretical knowledge with practical applications, the course equips participants with the skills and insights necessary to excel in accounting roles, navigate complex tax landscapes, and make informed financial decisions in an evolving business environment.

Upon successfully completing the "Certification Program in Accounting and Taxation with GST and Tally," participants will emerge with a robust skill set and comprehensive knowledge base essential for excelling in financial management and taxation. This encompassing program equips participants with the proficiency to conduct in-depth "financial analysis," enabling them to assess a company's financial health, performance, and potential areas for improvement. The course empowers participants with the skills for effective "tax planning," ensuring businesses and individuals can optimize their tax strategies while adhering to legal requirements. A strong emphasis on "record-keeping" imparts the ability to maintain accurate financial documentation, a fundamental practice for informed decision-making and regulatory compliance. Additionally, participants gain practical expertise in using accounting software like "Tally," facilitating streamlined financial operations, including ledger management, voucher entry, and generating financial reports. The course equips individuals with the know-how to navigate the complexities of "Goods and Services Tax (GST)," ensuring compliance with its regulations and efficient return filing. Overall, completing this program equips participants with a diverse skill set that empowers them to contribute effectively to various industries' financial management, taxation, and accounting roles.

We cover 3 modules of IBM in this course and they are Client Behavior Classification in Banking, Sectoral Analytics Fundamentals - Finance, and Sectoral Analytics Advanced - Finance. Please note that IBM believes in keeping their courses 100% relevant to the market trends, so they may archive/update the modules without any prior notice. In such a case, the EduBridge team will update the latest modules in the course curriculum and deliver the same to our learners.

Yes, the expert trainers at EduBridge will conduct online training for the IBM courses and ensure that the learners earn relevant badges. They will also get guidance on using the same on their resume and social media profiles. We follow a 60-40 approach in all our courses, so 60% of the training is led by the trainer and 40% of the course has to be completed by the learner.

Explore Related Courses

Broaden your horizons with our diverse courses; whether you're looking for related subjects or new interests, we have options to enrich your learning journey.