Subscribe

Subscribe to EduBridge Blogs

After Doctors and CA’s, Banking was considered one of the best and safest professions when it came to job stability. Every family considered it a white-collar job and a prestigious profession. Earlier banking was perceived as just monetary transactions of deposit and withdrawal. But today the profession has diversified into many facets like loans, investments, insurance, mutual funds, and equities. This diversification has given the banking sector the potential to become the third-largest sector by 2025. Today BFSI is valued at Rs. 90 trillion and has tremendous potential to create ample job opportunities. To fulfill the growing demand there has been the emergence of several courses for aspiring professionals and experienced individuals who want to specialize or upskill their interests. Through this blog, we focus on the kind of certificate courses in banking that will not only give you knowledge about banking terminologies and operations but also empower you to build client relations, crisis management, and upsell new products. So if you are thinking about what is next after the 12th or what to do after graduation then read on. But first, let us understand the profiles that one can choose if your professional interest lies in banking.

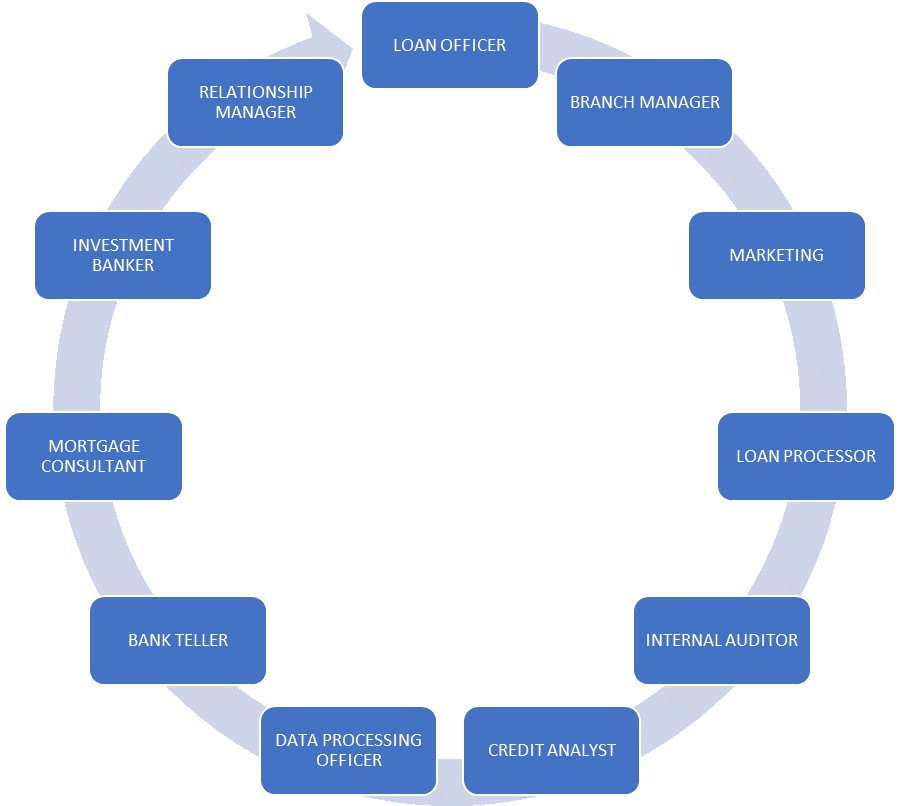

KEY BANKING PROFILES

Below are some of the recommended courses that you can opt for and post that choose other specialization options depending upon your interest.

CERTIFIED PROFESSIONAL IN BANKING & NON-BANKING FINANCIAL SERVICES:

This exclusive skill-building program focuses on creating a skilled workforce. The online master trainer-driven program prepares you to work on micro-finance loans in areas where the banks do not recognize such loan formats. This will help professionals understand the concepts and responsibilities of policies, review customer credit history, and get credit approvals as a Credit Officer. This program with building soft skills and increase competency levels as collection officers in Banking / NBFCs. It will also empower professionals to build customer relations that will not restrict their duties just to collect debts but also suggest alternatives for clearing their over dues and promote other products and services depending upon customer needs. Another interesting aspect that educational institutions follow is roleplayed which helps professionals understand different types of banks as per the RBI guidelines through mock live interactions.

Eligibility: 12th pass / Graduate / Post Graduate in any stream

CERTIFICATION PROGRAM IN INVESTMENT BANKING OPERATIONS:

Investment banking today has emerged as one of the most popular career choices as it has become one of the fastest-growing verticals in banking. This course will help aspirants to handle various roles and responsibilities of Asset Management like equity, debt, and derivatives that help organizations and investor to meet specific goals. The course also helps you understand practical operations of investment banking like portfolio management, advisory services, mergers, and acquisitions of both corporates and individuals. The course modules will cover Investment banking, Cash Equities, Fixed Income securities, Foreign exchange market, Derivatives, Reconciliation, Data Management, Asset management, MS Excel, and Powerpoint (IB).

Eligibility: Bachelors Degree or equivalent; Fresher with qualification like CA/ICWA/CS/CFA/CP; Working individuals with 0-3 years experience; 2 years master’s degree or equivalent from a recognized university in any discipline with 50% aggregate marks.

CERTIFICATION PROGRAM IN ACCOUNTING & TAXATION WITH GST AND TALLY:

A skilled accounting professional plays a key role in the success of an organization. The requirement for accountants is rapidly increasing for calculating and processing tax assessments for corporates and individuals. Such a course will help individuals understand the financial accounting sector in India. It also empowers these individuals to apply their skills for ethically saving on government taxes like GST, TDS, and Income Tax by efficient decision making. Through this course, you can learn accounting concepts like Bookkeeping fundamentals, Accrual accounting, Ratio, and Cash Flow Analysis, Stock valuation. Other concepts like Tally, GST, Payroll taxation, and TDS too will be covered which will give you an added advantage.

Eligibility: 12th Pass/ Graduate/Post Graduate (Any Stream). Working professions with 0 – 3 years of work experience looking for Advance Certification in Accounts

The above courses are best for laying a foundation in the banking sector. After successful completion of these courses, one can scale up their profile by taking up specialized courses in specific sectors. One can embrace the banking career to enjoy benefits like:

- One of the most rewarding workspace

- Perks like insurance, bonus, allowances, etc

- Post-retirement benefits

A career in the banking sector is surely rewarding but it is all about hard work and dedication. It is imperative to have quality learning and constant upskilling that takes you along way.

Recent Blogs

Related Blogs

Accelerate Your Career with Expert Guidance and Guaranteed Job*!

"*" indicates required fields